AMD stock surged over 25% in premarket trading after news broke that OpenAI is set to take a significant stake in the AI chipmaker. The partnership highlights the growing importance of high-performance GPUs in powering the next generation of artificial intelligence.

OpenAI’s Bold Move Into AMD

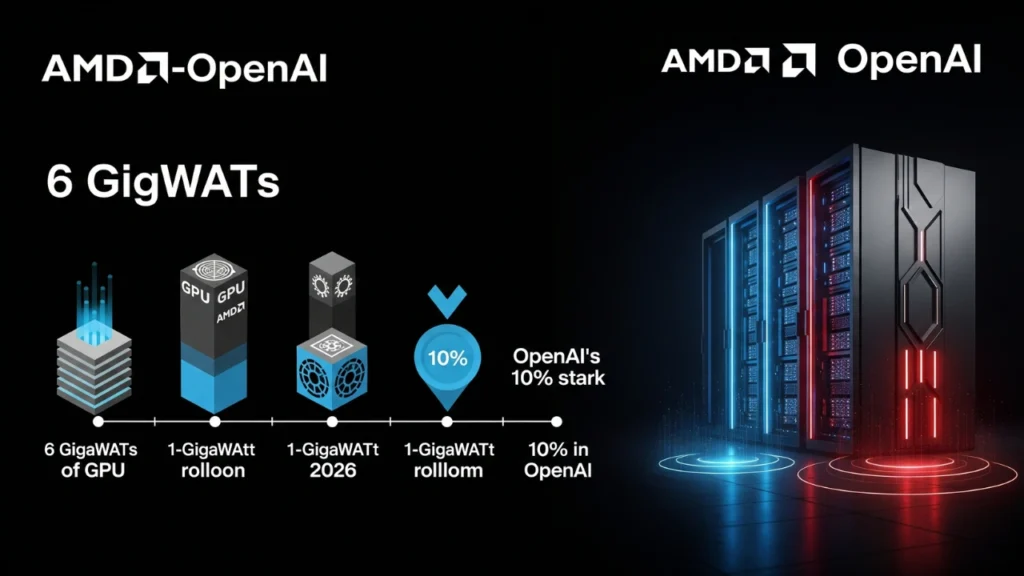

OpenAI, led by CEO Sam Altman, is planning to acquire up to a 10% stake in AMD, signaling a major strategic collaboration. The deal includes deploying up to 6 gigawatts of AMD Instinct GPUs over multiple years, starting with a 1-gigawatt rollout in 2026.

“This partnership with AMD will accelerate AI development and bring advanced AI benefits to everyone faster,” Altman said, emphasizing AMD’s growing role in the generative AI landscape.

How the Warrant Agreement Works

As part of the tie-up, AMD issued OpenAI a warrant for up to 160 million shares of AMD stock. Vesting of these shares is tied to both deployment milestones and AMD’s stock price, ensuring that the deal scales as OpenAI’s GPU rollout expands.

Also Read

The first tranche vests with the initial 1-gigawatt deployment, with additional tranches unlocking as OpenAI reaches 6 gigawatts and hits key technical and commercial milestones. If fully exercised, OpenAI could secure approximately 10% ownership in AMD, a move that could reshape investor expectations for AMD stock price growth.

Strategic Significance for AMD

For AMD, this deal is a major commercial and technological milestone. After trailing Nvidia in the AI accelerator market, AMD now has a high-profile customer at the forefront of generative AI.

AMD CEO Lisa Su called the partnership a “true win-win, enabling the world’s most ambitious AI buildout and advancing the entire AI ecosystem.”

This collaboration also positions AMD as a core supplier in OpenAI’s ambitious Stargate project, which involves building large-scale AI infrastructure across multiple U.S. locations, including Texas, New Mexico, Ohio, and the Midwest.

The Bigger AI Hardware Picture

The OpenAI-AMD deal comes shortly after OpenAI announced a $100 billion equity-and-supply agreement with Nvidia. While Nvidia is providing capital and hardware, AMD will now supply GPUs with the potential for OpenAI ownership.

The partnership adds a new layer to the AI ecosystem, where companies like Nvidia, AMD, Broadcom, and Oracle collaborate in a tightly interconnected “AI economy” of capital, equity, and compute. Analysts warn that any disruption in this chain could create pressure on the supply side.

What This Means for Investors

With OpenAI committing billions to AI infrastructure, AMD’s positioning as a high-performance chip provider has never been stronger. The news has already pushed AMD stock higher, reflecting investor confidence in the company’s future growth prospects.

As generative AI continues its rapid adoption, AMD’s leadership in AI chips, combined with strategic partnerships like this one, ensures it remains a central player in the next wave of AI innovation.

FAQ Section

Q1: Why did AMD stock rise after the OpenAI deal?

AMD stock surged over 25% as OpenAI announced plans to acquire a 10% stake and deploy up to 6GW of AMD Instinct GPUs.

Q2: How much of AMD will OpenAI own?

If OpenAI exercises its full warrant, it could acquire approximately 10% ownership of AMD based on current shares outstanding.

Q3: What is the timeline for AMD GPU deployment by OpenAI?

OpenAI plans to begin with a 1-gigawatt rollout in the second half of 2026, eventually scaling up to 6 gigawatts over multiple years.

Q4: How does this deal impact AMD’s position in the AI market?

The partnership validates AMD’s next-generation Instinct roadmap, positioning the company as a key supplier in generative AI and strengthening its market presence.