If you’ve ever felt like the world of money is written in a language only Wall Street insiders understand, you’re not alone. Today, financial literacy isn’t just helpful—it’s essential. Whether you’re saving up for emergencies, exploring the world of investing, or trying to understand digital income opportunities, people everywhere are searching for clarity. The problem? Most traditional finance resources feel dense, technical, and—let’s be honest—pretty intimidating.

That’s exactly where FinanceCub com steps in. Think of it as a friendly guide that sits beside you, breaks things down in simple terms, and reminds you that understanding money doesn’t have to feel like decoding a secret government file. In this deep-dive piece, we’ll walk through what FinanceCub com is all about, the topics it covers, who benefits most, and why so many beginners are turning to it as their go-to starting point.

What Exactly Is FinanceCub com?

At its core, FinanceCub com is an educational platform built with one purpose: make finance simple for everyday people. No jargon, no pressure, and no assumption that you already know what things like “SIPs,” “blockchain,” or “liquid funds” even mean.

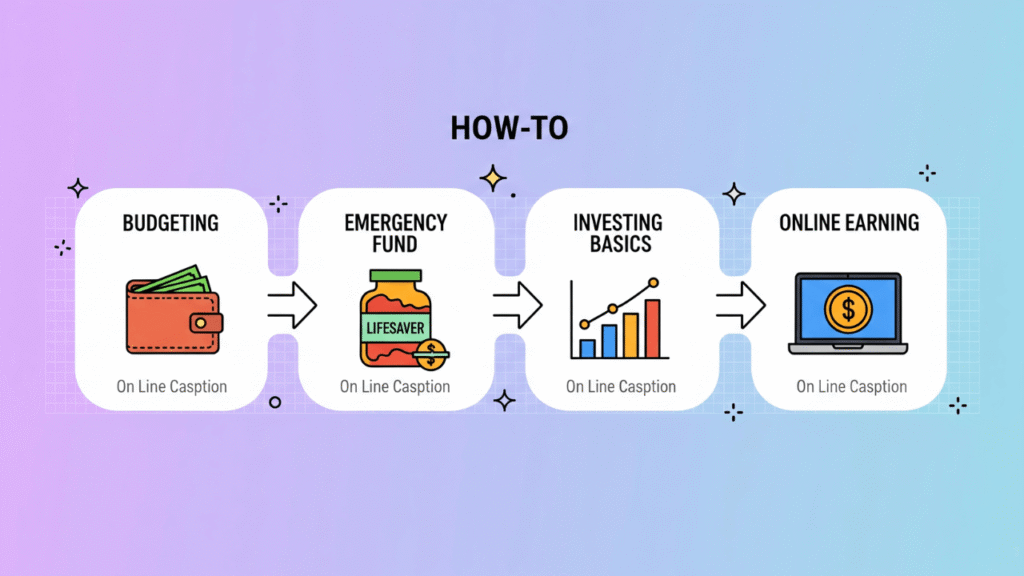

The website focuses on explaining essential money topics in plain English—budgeting, investing basics, online earning options, saving habits, and more. Instead of overwhelming readers with advanced strategies, it offers a foundation—something solid beginners can actually build on.

Also Read

FinanceCub com doesn’t claim to turn you into a millionaire overnight. What it does offer is confidence. And for someone taking their first baby steps into personal finance, that’s everything.

Why Are So Many People Turning to Beginner-Friendly Finance Platforms?

Let’s be real: money is changing. Fast. Young adults are entering the stock market earlier than ever. Crypto has exploded into mainstream conversation. And digital earning—whether freelancing, affiliate income, or skill-based work—has become a legitimate path for millions.

But here’s the catch: without proper guidance, navigating these areas can feel like trying to fly a plane after watching one YouTube tutorial.

People want resources that are:

- Simple

- Beginner-focused

- Free of unnecessary jargon

- Practical and relatable

That’s why FinanceCub com is gaining traction—not because it’s flashy or complicated, but because it speaks the language people need right now.

Breaking Down the Key Features of FinanceCub com

1. Clear and Easy Financial Explanations

If you’ve ever read a finance article and needed another article to explain what the first one said, you’ll appreciate this. FinanceCub com breaks down everything—budgeting, SIPs, credit scores, emergency funds, stock basics—into bite-sized, easy-to-follow explanations.

For someone starting from scratch, this clarity is a breath of fresh air.

2. Guidance on Digital Earning Opportunities

Side hustles are no longer trendy—they’re necessary. The platform touches on:

- Freelancing

- Skill-based online work

- Affiliate earning

- Beginner-friendly business ideas

It doesn’t promise overnight riches (thankfully). Instead, it focuses on realistic, sustainable online earning possibilities.

3. Beginner-Level Crypto and Tech Insights

Crypto still scares a lot of people—and honestly, for good reason. But FinanceCub com takes a softer, safer approach. It explains:

- Blockchain

- Digital assets

- Basic crypto concepts

No hype. No pressure to “buy before it’s too late.” Just clear information meant to help beginners understand the landscape.

4. Strong Focus on Personal Finance & Money Management

Good financial decisions start with daily habits. FinanceCub com covers areas like:

- Saving routines

- Managing expenses

- Reducing debt

- Building long-term habits

It’s not flashy, but it’s the kind of content that helps people build real financial stability.

If you’re exploring beginner-friendly financial tools and want to compare platforms that help you trade, invest, and analyze markets, you may also want to check out MyFastBroker. com Review: All-in-One Trading Platform Guide. It offers a detailed, easy-to-follow breakdown of a versatile trading platform that supports stocks, crypto, and bonds—making it a helpful companion resource as you continue your financial learning journey.

Is FinanceCub com Actually Reliable for Beginners?

Transparency is a big deal when it comes to finance. And FinanceCub com is clear about what it offers: education, not investment advice.

Here’s what works in its favor:

- It provides understandable, foundational guidance

- It avoids risky shortcuts and unrealistic promises

- It focuses on habits, not hype

- It doesn’t push advanced strategies meant for pros

For someone starting from zero, this makes FinanceCub com a trustworthy learning space—simple, safe, and confidence-building.

Pros and Cons of FinanceCub com

✔ Pros

- Content is easy to grasp

- Perfect for complete beginners

- Covers a broad range of finance topics

- Includes crypto and online earning basics

- Free to access

- Clean, user-friendly layout

✘ Cons

- Not suitable for advanced investors

- Lacks deep expert-certified analysis

- No trading tools or technical charts

These points make it clear: FinanceCub com is ideal for learning the basics, but it’s not designed for professional-level finance enthusiasts.

Who Benefits the Most from FinanceCub com?

This platform is a match for:

- Students who want a head start on financial awareness

- New investors looking for simple guidance

- Individuals exploring digital earning paths

- Anyone overwhelmed by overly technical finance sites

If you’re already deep into trading, analytics, or professional finance tools, you may find it too intro-level. But for beginners? It’s exactly what they need.

Final Verdict: Why FinanceCub com Is Worth Your Time

FinanceCub com does something many finance websites fail to do—it speaks directly to beginners without drowning them in terminology or unrealistic expectations. Instead of promising wealth, it promises understanding, and that matters far more in the long run.

It won’t replace professional advice. It won’t make you a stock expert overnight. But it will help you understand the basics well enough to make informed decisions and take control of your financial journey.

If you’re just starting your financial education, FinanceCub com feels like a steady hand guiding you through your first steps—clear, uncomplicated, and surprisingly empowering.

FAQs

What topics does FinanceCub com cover?

Investing basics, budgeting, personal finance, crypto introductions, and digital earning opportunities.

Is the platform free?

Yes—access to its educational content is completely free.

Does it offer investment advice?

No. It provides general educational insights, not personalized recommendations.

Is it suitable for beginners?

Absolutely. The content is tailored specifically for people with zero prior finance experience.

Does it explain cryptocurrency?

Yes, but only at the beginner level—safe, simple, and informational.

Is it helpful for advanced users?

Advanced finance enthusiasts may find it too basic, as the platform focuses on fundamentals rather than technical analysis.